Annuities Provide Financial Stability and Retirement Security

January 29, 2025

As retirement planning becomes increasingly complex, annuities remain a popular choice for individuals seeking long-term financial stability. Annuities offer the unique benefit of guaranteed lifetime income, protecting retirees from market downturns, inflation, and longevity risk.

In this article, we explore why annuity owners highly value the benefits of lifetime income and how these financial products can enhance retirement security.

1. Guaranteed Lifetime Income: A Financial Safety NetOne of the biggest advantages of annuities is their ability to provide a steady income stream for life. Unlike traditional investment vehicles that fluctuate with market performance, annuities offer:

For many retirees, the peace of mind that comes with guaranteed income outweighs the potential returns of riskier investments.

2. Protection Against Market VolatilityStock market fluctuations can significantly impact retirement savings, especially during economic downturns. Annuities shield retirees from market risks by offering:

By offering protection from financial uncertainty, annuities help retirees maintain their standard of living, even during market downturns.

3. Tax Advantages of AnnuitiesAnnuities offer tax-deferred growth, meaning investors don’t pay taxes on earnings until they begin receiving payouts. Key tax benefits include:

These tax benefits make annuities an attractive option for long-term wealth accumulation and retirement income planning.

4. Customization and FlexibilityAnnuities come in various forms, allowing individuals to choose the best option for their financial goals. Common types of annuities include:

This flexibility enables retirees to tailor annuities to their specific income needs and risk tolerance.

5. Inflation Protection for Long-Term SecurityInflation erodes purchasing power over time, making it essential to have income sources that keep pace with rising costs. Many annuities offer inflation-adjusted options that:

Inflation protection ensures that annuity owners can maintain their lifestyle throughout retirement.

6. Death Benefits and Wealth TransferAnnuities are not just for retirement income—they can also serve as estate planning tools. Benefits include:

For those looking to leave a financial legacy, annuities offer structured and tax-efficient wealth transfer options.

7. Psychological and Emotional Benefits of AnnuitiesFinancial security is not just about numbers—it also impacts emotional well-being. Annuity owners experience:

This sense of security makes annuities a preferred choice for many retirees.

8. How to Determine If an Annuity Is Right for YouWhile annuities provide significant benefits, they may not be suitable for everyone. Factors to consider include:

Consulting with a financial advisor can help determine whether an annuity aligns with an individual’s retirement strategy

Investing in Future Trends for Long-Term Growth

Thematic investing focuses on future trends shaping industries. Learn how to capitalize on tomorrow’s opportunities today

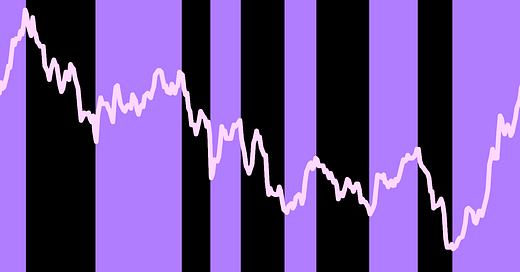

Markets React Positively as Election-Driven Optimism Grows

Stock markets are experiencing a strong post-election rally, driven by investor optimism, policy expectations, and economic growth prospects. Will the momentum continue

Annuities Provide Financial Stability and Retirement Security

Annuities offer retirees a reliable stream of lifetime income, protecting them from market volatility and ensuring long-term financial security

The bank repositions its operations, scaling back in Europe, UK, and the Americas.

HSBC is undertaking its largest investment banking retrenchment in decades, planning to exit its M&A and ECM operations in key Western markets. This restructuring focuses on shifting resources to Asia and the Middle East while consolidating debt capital markets and finance-led activities

Stock Market Trends, Economic Updates, and Investment Insights

This week, U.S. markets faced volatility amid earnings reports, Federal Reserve signals, and economic data releases. Investors analyze inflation trends and interest rate forecasts while navigating sector-specific shifts in technology, energy, and financial markets.

Value stocks remain underappreciated as investors focus on growth

Despite historical outperformance over the long term, value stocks remain underweight in many portfolios. With markets favoring growth and technology stocks, are investors overlooking key opportunities in undervalued assets

Stocks remain resilient despite rising interest rates—here’s why.

Higher interest rates often trigger fears of a market downturn, but historical data suggests otherwise. While some sectors face challenges, others thrive in a high-rate environment. Investors should focus on strategic allocation rather than panic selling

Market predictions and trends shaping the equity landscape in Q1 2025

The Q1 2025 equity market outlook explores key factors shaping investor sentiment and market direction, including global economic trends, corporate earnings, and sector rotations. Understanding these factors will be crucial for positioning portfolios in the coming months

Cyclical stocks and economic growth trends lead the market rally.

Economic resilience continues to support a robust cyclical rally, as key sectors benefit from sustained recovery. This outlook emphasizes growth in consumer demand, infrastructure, and industrials, driving cyclical stock performance

The Atlantic Daily

Get our guide to the day’s biggest news and ideas, delivered to your inbox every weekday and Sunday mornings. See more newsletters

.webp)

Ideas That Matter

Subscribe and support more than 160 years of independent journalism.

Subscribe