Global Markets React to US Policy Shifts and Wall Street Volatility

February 28, 2025

In recent weeks, Wall Street has experienced significant volatility, largely driven by shifts in US economic policies. The US Federal Reserve's policy changes, as well as fiscal and regulatory adjustments at the government level, are influencing investor sentiment both domestically and globally. This article delves into the underlying causes of this market turbulence, its impact on global trade, and what investors can expect in the coming months.

The Causes of Wall Street VolatilityWall Street's recent volatility can be attributed to a combination of monetary policy shifts, fiscal policy changes, and geopolitical uncertainties. These factors have collectively influenced investor behavior, creating an environment of uncertainty in both US and global markets.

Monetary Policy Shifts: One of the primary drivers of recent volatility is the Federal Reserve's actions. With interest rates on the rise, due to ongoing inflation concerns, investors are reacting by adjusting their portfolios. The Fed’s rate hikes have made borrowing costs higher, which affects corporate profits and growth expectations. As borrowing becomes more expensive, businesses may scale back on investments and expansion plans, which impacts stock prices and investor sentiment.

Fiscal Policy Adjustments: Fiscal policies enacted by the US government also play a significant role in shaping the current economic landscape. Recently, there have been debates over tax reform, government spending, and changes to social welfare programs. These policy changes are expected to have both short-term and long-term effects on the economy and investor confidence.

Geopolitical Factors and Global Events: Beyond US policy changes, geopolitical tensions and global economic events have further contributed to the volatility. From supply chain disruptions to trade wars and military conflicts, these uncertainties are affecting investor decisions worldwide.

Global Trade Disruptions: Rising tariffs, international sanctions, and global trade wars have resulted in supply chain interruptions that continue to influence markets. For example, increased commodity prices due to trade restrictions can hurt companies relying on raw materials for production.

Energy Price Volatility: Energy prices, particularly oil and gas, are another source of uncertainty. Fluctuations in the cost of energy can impact everything from consumer spending to corporate profit margins, further intensifying market swings.

The volatility seen on Wall Street is not limited to US stocks alone. Global markets are also reacting to these changes in US policies. Emerging markets, European equities, and Asian stock exchanges are all feeling the impact of US monetary tightening and fiscal policy shifts.

US Stock Market:

Global Markets:

As the global economic landscape continues to shift due to US policy changes, investors need to stay informed and adapt their strategies accordingly. Here are some key considerations for navigating the current market volatility:

Diversification is Key: Investors should ensure their portfolios are well-diversified across asset classes, industries, and regions. Bonds, stocks, real estate, and commodities all respond differently to changes in interest rates and government policies. By diversifying, investors can reduce their exposure to any single asset class that may be impacted by volatile conditions.

Focus on High-Quality Stocks: During times of uncertainty, investors may want to focus on quality stocks—companies with strong balance sheets, consistent earnings growth, and proven management. These stocks tend to be more resilient during market downturns and provide better protection against volatility.

Consider Fixed-Income Alternatives: Rising interest rates can create challenges for bond investors, but they also provide opportunities. Short-duration bonds, floating-rate bonds, and municipal bonds may offer attractive returns with less sensitivity to interest rate changes. Additionally, high-yield bonds could provide higher income potential for risk-tolerant investors.

Stay Updated on Federal Reserve Policy: The Federal Reserve’s actions will continue to influence market conditions. Investors should stay updated on the Fed’s policy statements and its stance on interest rates and inflation. These decisions will have significant ramifications for both the bond and equity markets.

Monitor Geopolitical Developments: Geopolitical events can have a profound impact on market volatility. Investors should monitor global developments, particularly in trade relations, oil prices, and regulatory changes in major economies. Political risks and international conflicts can quickly shift investor sentiment and influence market performance

Investing in Future Trends for Long-Term Growth

Thematic investing focuses on future trends shaping industries. Learn how to capitalize on tomorrow’s opportunities today

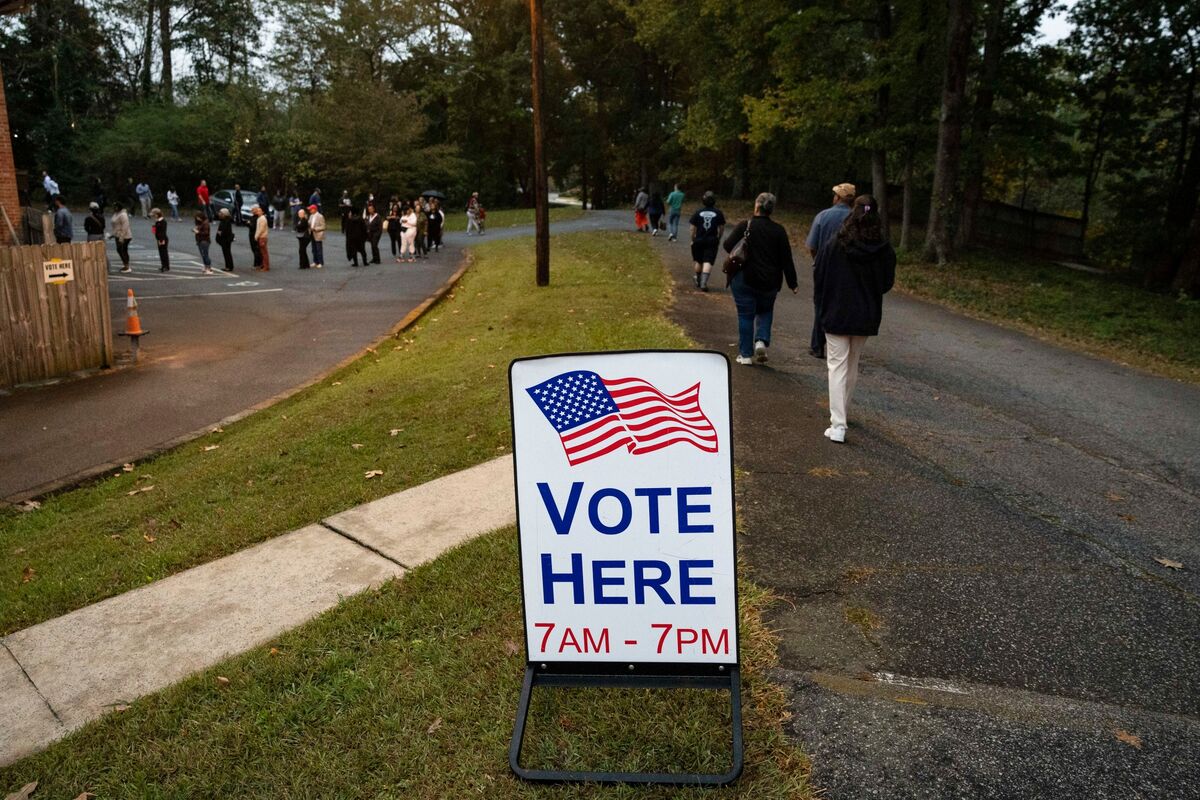

Markets React Positively as Election-Driven Optimism Grows

Stock markets are experiencing a strong post-election rally, driven by investor optimism, policy expectations, and economic growth prospects. Will the momentum continue

Annuities Provide Financial Stability and Retirement Security

Annuities offer retirees a reliable stream of lifetime income, protecting them from market volatility and ensuring long-term financial security

The bank repositions its operations, scaling back in Europe, UK, and the Americas.

HSBC is undertaking its largest investment banking retrenchment in decades, planning to exit its M&A and ECM operations in key Western markets. This restructuring focuses on shifting resources to Asia and the Middle East while consolidating debt capital markets and finance-led activities

Stock Market Trends, Economic Updates, and Investment Insights

This week, U.S. markets faced volatility amid earnings reports, Federal Reserve signals, and economic data releases. Investors analyze inflation trends and interest rate forecasts while navigating sector-specific shifts in technology, energy, and financial markets.

Value stocks remain underappreciated as investors focus on growth

Despite historical outperformance over the long term, value stocks remain underweight in many portfolios. With markets favoring growth and technology stocks, are investors overlooking key opportunities in undervalued assets

Stocks remain resilient despite rising interest rates—here’s why.

Higher interest rates often trigger fears of a market downturn, but historical data suggests otherwise. While some sectors face challenges, others thrive in a high-rate environment. Investors should focus on strategic allocation rather than panic selling

Market predictions and trends shaping the equity landscape in Q1 2025

The Q1 2025 equity market outlook explores key factors shaping investor sentiment and market direction, including global economic trends, corporate earnings, and sector rotations. Understanding these factors will be crucial for positioning portfolios in the coming months

Cyclical stocks and economic growth trends lead the market rally.

Economic resilience continues to support a robust cyclical rally, as key sectors benefit from sustained recovery. This outlook emphasizes growth in consumer demand, infrastructure, and industrials, driving cyclical stock performance

The Atlantic Daily

Get our guide to the day’s biggest news and ideas, delivered to your inbox every weekday and Sunday mornings. See more newsletters

.webp)

Ideas That Matter

Subscribe and support more than 160 years of independent journalism.

Subscribe