Understanding the Impact of Federal Reserve Rate Hikes on Investments

February 28, 2025

The Federal Reserve has once again raised interest rates as part of its ongoing efforts to combat inflation and stabilize the U.S. economy. The latest rate hikes are the result of the Fed’s continued strategy of tightening monetary policy to address inflationary pressures that have remained stubbornly high in recent years. For investors, these rate hikes are critical to understanding the evolving landscape of financial markets. As borrowing costs increase, there are ripple effects that touch nearly every part of the economy.

The Federal Reserve’s Role and Rate HikesThe Federal Reserve (Fed) plays a pivotal role in the U.S. economy by setting interest rates that influence everything from consumer borrowing to business investments. The federal funds rate, which is the rate at which banks lend to one another overnight, is the tool the Fed uses to manage economic growth, inflation, and employment.

When the economy is growing too quickly, and inflation is rising, the Fed may raise interest rates to cool things down. Conversely, when the economy is slowing, and inflation is low, the Fed may lower rates to stimulate borrowing and spending. The recent decision to hike rates is a response to inflationary pressures that have persisted throughout the economy.

How Higher Interest Rates Impact Different Asset Classes 1. Stock MarketThe stock market typically reacts negatively to interest rate hikes, especially in the short term. Higher interest rates mean higher borrowing costs for companies, which can lead to reduced profitability. Companies that rely on debt to finance growth, such as those in the tech sector, may face higher costs of capital, which can weigh down their stock prices. Additionally, the higher yield on bonds may make them more attractive relative to stocks, causing investors to shift capital away from equities.

The bond market is perhaps the most directly affected by interest rate hikes. As rates rise, the yield on new bonds increases, making them more attractive compared to existing bonds with lower yields. The value of existing bonds with fixed interest payments declines as a result.

Real estate is another sector that can be significantly impacted by rising interest rates. Higher borrowing costs translate into higher mortgage rates, which can dampen demand for home purchases and commercial real estate investments. As mortgage rates rise, consumers may become less willing to take on large amounts of debt, leading to a slowdown in the housing market.

Commodities like gold, oil, and agricultural products can also feel the impact of rising interest rates. When the Fed raises rates, the U.S. dollar tends to strengthen, making commodities priced in dollars more expensive for foreign buyers. This can lead to a decline in commodity prices in global markets.

The foreign exchange (FX) market can experience significant volatility in response to changes in interest rates. When the Fed raises rates, it typically causes the U.S. dollar to appreciate, as investors seek higher yields on dollar-denominated assets.

While rising interest rates pose challenges for certain asset classes, there are strategies that investors can consider to manage the impact.

1. Focus on Shorter Duration BondsIn a rising rate environment, short-duration bonds tend to be less impacted by rate hikes than long-term bonds. Investors may want to adjust their portfolios by shifting towards bonds with shorter maturities to reduce interest rate risk.

2. Consider Dividend-Paying StocksAs interest rates rise, dividend stocks can become an attractive option, especially those in defensive sectors like utilities, consumer staples, and healthcare. These stocks may offer more stability and income during periods of volatility.

3. Look for Inflation HedgesInflation-linked securities like TIPS can help protect against rising costs, while commodities like gold may offer a safe haven if inflation expectations increase.

4. Diversify Across Asset ClassesDiversification remains a key strategy for investors navigating periods of rising rates. By holding a mix of stocks, bonds, real estate, and commodities, investors can reduce risk and potentially capture opportunities across different market conditions.

Investing in Future Trends for Long-Term Growth

Thematic investing focuses on future trends shaping industries. Learn how to capitalize on tomorrow’s opportunities today

Markets React Positively as Election-Driven Optimism Grows

Stock markets are experiencing a strong post-election rally, driven by investor optimism, policy expectations, and economic growth prospects. Will the momentum continue

Annuities Provide Financial Stability and Retirement Security

Annuities offer retirees a reliable stream of lifetime income, protecting them from market volatility and ensuring long-term financial security

The bank repositions its operations, scaling back in Europe, UK, and the Americas.

HSBC is undertaking its largest investment banking retrenchment in decades, planning to exit its M&A and ECM operations in key Western markets. This restructuring focuses on shifting resources to Asia and the Middle East while consolidating debt capital markets and finance-led activities

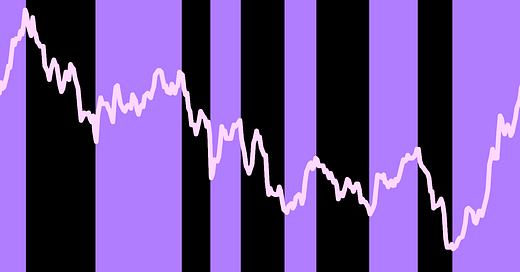

Stock Market Trends, Economic Updates, and Investment Insights

This week, U.S. markets faced volatility amid earnings reports, Federal Reserve signals, and economic data releases. Investors analyze inflation trends and interest rate forecasts while navigating sector-specific shifts in technology, energy, and financial markets.

Value stocks remain underappreciated as investors focus on growth

Despite historical outperformance over the long term, value stocks remain underweight in many portfolios. With markets favoring growth and technology stocks, are investors overlooking key opportunities in undervalued assets

Stocks remain resilient despite rising interest rates—here’s why.

Higher interest rates often trigger fears of a market downturn, but historical data suggests otherwise. While some sectors face challenges, others thrive in a high-rate environment. Investors should focus on strategic allocation rather than panic selling

Market predictions and trends shaping the equity landscape in Q1 2025

The Q1 2025 equity market outlook explores key factors shaping investor sentiment and market direction, including global economic trends, corporate earnings, and sector rotations. Understanding these factors will be crucial for positioning portfolios in the coming months

Cyclical stocks and economic growth trends lead the market rally.

Economic resilience continues to support a robust cyclical rally, as key sectors benefit from sustained recovery. This outlook emphasizes growth in consumer demand, infrastructure, and industrials, driving cyclical stock performance

The Atlantic Daily

Get our guide to the day’s biggest news and ideas, delivered to your inbox every weekday and Sunday mornings. See more newsletters

.webp)

Ideas That Matter

Subscribe and support more than 160 years of independent journalism.

Subscribe