Key Drivers Behind the S&P 500's Record High in 2025

February 28, 2025

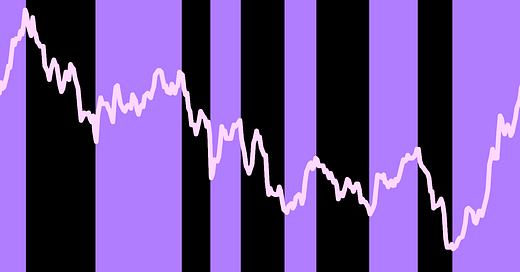

The S&P 500, a benchmark index that tracks of the largest publicly traded companies in the United States, has reached new heights in 2025, surpassing previous records and signaling robust market performance. This surge in stock prices has captured the attention of investors, analysts, and market observers alike. But what’s driving this remarkable rally?

Several key factors are contributing to the S&P 500’s success in 2025, including strong corporate earnings growth, the ongoing economic recovery following the pandemic, and an influx of investor optimism. In this article, we explore the primary drivers behind the index’s performance and what it means for the broader market.

Corporate Earnings Growth: The Bedrock of the RallyOne of the primary reasons behind the S&P 500’s record-breaking performance is solid corporate earnings growth. After several years of uncertainty and economic disruption due to the COVID-pandemic, companies across various sectors have shown resilience and adaptability. Many have not only recovered but also exceeded earnings expectations.

Tech Sector Dominance: The technology sector, which holds a significant weight in the S&P 500, continues to outperform. Major companies such as Apple, Microsoft, Alphabet, and Nvidia have posted strong earnings, benefiting from high demand for digital services, cloud computing, and artificial intelligence (AI) advancements. As technology companies continue to lead the charge, they provide a solid foundation for the broader index’s performance.

Consumer Goods and Services: The consumer goods sector has also contributed to the rally. With consumer demand returning to pre-pandemic levels, companies like Procter & Gamble, Coca-Cola, and PepsiCo have seen revenue growth, further propelling the S&P 500.

Financial Sector Performance: Banks and financial institutions have enjoyed favorable market conditions in 2025. JPMorgan Chase, Goldman Sachs, and other major financial institutions have benefited from a combination of rising interest rates, which have improved net interest margins, and strong loan growth.

The economic recovery following the pandemic has been another critical factor driving the rally. Governments around the world, particularly in the US, have implemented stimulus packages, while the Federal Reserve has maintained accommodative policies to stimulate growth. As economies reopen and vaccination efforts progress, consumer confidence has surged, contributing to strong economic growth.

Job Growth and Wage Increases: The US labor market has seen significant improvement, with unemployment rates falling to historic lows. Job growth, coupled with rising wages, has spurred consumer spending, which is a major driver of economic activity.

GDP Growth: In 2025, the US economy has shown consistent growth, with GDP rising at a healthy pace. This economic expansion has boosted investor sentiment, as traders expect that the corporate sector will continue to thrive in a growing economy.

Global Economic Conditions: The global economic recovery has also played a role in supporting US markets. As major economies like the European Union, China, and India recover from the pandemic’s economic toll, international trade and investment have flourished, benefiting US-based multinational corporations.

Investor sentiment has been one of the key catalysts for the S&P 500’s record performance. In 2025, there has been an influx of both institutional and retail investors into the market, as confidence in the economy and corporate earnings has remained high.

Low-Interest Rates and Easy Monetary Policy: Despite some tightening measures by the Federal Reserve, interest rates remain relatively low compared to historical standards. This has kept borrowing costs low for businesses and consumers, making investments in equities more attractive than other asset classes like bonds or savings accounts.

Retail Investor Participation: In recent years, retail investors have gained a larger share of the market, thanks to the rise of online trading platforms and low-cost brokerage services. The surge of retail investment has contributed to increased trading volumes and stock prices, particularly in popular growth sectors like tech, renewables, and healthcare.

AI and Tech Investment Boom: The rise of artificial intelligence (AI), machine learning, and automation technologies has sparked a new wave of investment. Companies involved in AI development are seeing a significant increase in stock prices, further fueling the market rally. As AI transforms industries ranging from healthcare to automotive manufacturing, investors are optimistic about the future growth prospects of these companies.

In addition to domestic factors, geopolitical stability has played a role in investor confidence. While risks remain, such as potential tensions with China or Europe, the overall political climate in the US has been relatively stable. This stability, combined with the Biden administration's pro-business policies, has created a favorable environment for investors.

US-China Trade Relations: Although US-China relations remain tense, there has been progress in areas like trade agreements and intellectual property rights. As global trade continues to recover, US-based multinational companies have benefited from increased access to international markets.

Federal Reserve Policy: The Federal Reserve's monetary policy has been pivotal in maintaining investor optimism. Although there has been talk of tapering stimulus measures and raising interest rates, the central bank has been cautious in its approach, ensuring that the economy doesn’t overheat.

As the S&P hits record highs, it is important to consider how this performance impacts other areas of the financial markets.

Sector Rotation: Investors are increasingly looking at a sector rotation, where growth stocks are trading at higher valuations than traditional value stocks. While tech stocks have led the rally, investors are beginning to look at other sectors such as renewables, healthcare, and consumer discretionary, which are also benefiting from favorable macroeconomic conditions.

Cryptocurrency and Digital Assets: The performance of the S&P has been mirrored by the growth in digital assets, particularly cryptocurrencies and blockchain technology. As traditional financial markets perform well, institutional investors have been more willing to diversify into alternative assets like Bitcoin, Ethereum, and other digital currencies.

Real Estate Investment: The strong performance of the stock market has had a knock-on effect on real estate investments. Many investors are turning to real estate as a hedge against inflation, pushing demand for both residential and commercial properties.

Investing in Future Trends for Long-Term Growth

Thematic investing focuses on future trends shaping industries. Learn how to capitalize on tomorrow’s opportunities today

Markets React Positively as Election-Driven Optimism Grows

Stock markets are experiencing a strong post-election rally, driven by investor optimism, policy expectations, and economic growth prospects. Will the momentum continue

Annuities Provide Financial Stability and Retirement Security

Annuities offer retirees a reliable stream of lifetime income, protecting them from market volatility and ensuring long-term financial security

The bank repositions its operations, scaling back in Europe, UK, and the Americas.

HSBC is undertaking its largest investment banking retrenchment in decades, planning to exit its M&A and ECM operations in key Western markets. This restructuring focuses on shifting resources to Asia and the Middle East while consolidating debt capital markets and finance-led activities

Stock Market Trends, Economic Updates, and Investment Insights

This week, U.S. markets faced volatility amid earnings reports, Federal Reserve signals, and economic data releases. Investors analyze inflation trends and interest rate forecasts while navigating sector-specific shifts in technology, energy, and financial markets.

Value stocks remain underappreciated as investors focus on growth

Despite historical outperformance over the long term, value stocks remain underweight in many portfolios. With markets favoring growth and technology stocks, are investors overlooking key opportunities in undervalued assets

Stocks remain resilient despite rising interest rates—here’s why.

Higher interest rates often trigger fears of a market downturn, but historical data suggests otherwise. While some sectors face challenges, others thrive in a high-rate environment. Investors should focus on strategic allocation rather than panic selling

Market predictions and trends shaping the equity landscape in Q1 2025

The Q1 2025 equity market outlook explores key factors shaping investor sentiment and market direction, including global economic trends, corporate earnings, and sector rotations. Understanding these factors will be crucial for positioning portfolios in the coming months

Cyclical stocks and economic growth trends lead the market rally.

Economic resilience continues to support a robust cyclical rally, as key sectors benefit from sustained recovery. This outlook emphasizes growth in consumer demand, infrastructure, and industrials, driving cyclical stock performance

The Atlantic Daily

Get our guide to the day’s biggest news and ideas, delivered to your inbox every weekday and Sunday mornings. See more newsletters

.webp)

Ideas That Matter

Subscribe and support more than 160 years of independent journalism.

Subscribe