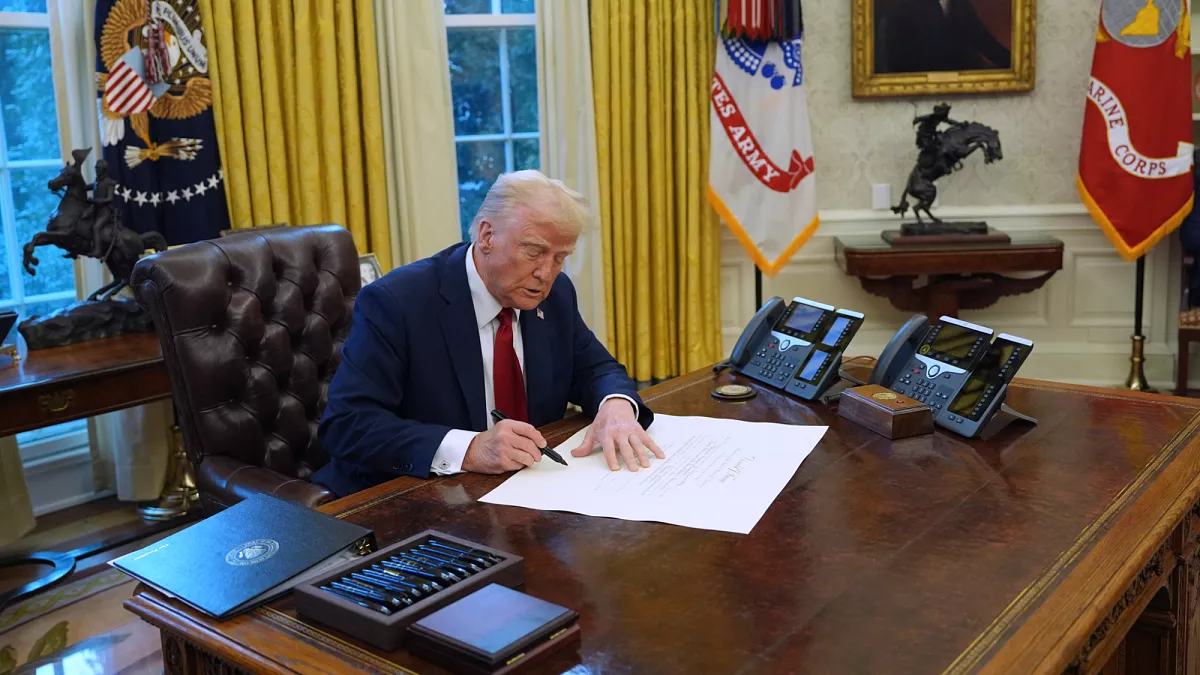

Trump unveils $5M ‘Gold Card’ visa to attract wealthy investors.

February 27, 2025

Donald Trump has announced a bold new immigration policy proposal that could reshape how the United States attracts foreign investment. The former president is advocating for a $million "Gold Card" visa program, aimed at high-net-worth individuals willing to invest substantial capital into the U.S. economy. The initiative, which could serve as an alternative to the EB-visa program, is expected to spark debates about wealth-based immigration and economic stimulation.

A New Approach to Investor ImmigrationTrump’s "Gold Card" visa proposal seeks to incentivize foreign billionaires and multimillionaires to contribute to the U.S. economy. Under the plan, individuals who invest a minimum of $million into American businesses, real estate, or infrastructure projects would be eligible for a fast-tracked residency visa. The program is designed to attract global investors who can create jobs and stimulate economic growth.

Comparisons to the EB-Visa ProgramCurrently, the EB-Immigrant Investor Program allows foreign investors to obtain a U.S. green card by investing at least $800,in targeted employment areas. However, this program has faced backlogs, regulatory challenges, and fraud concerns. Trump's "Gold Card" visa, with a significantly higher investment threshold, aims to streamline the process while ensuring that only ultra-wealthy individuals qualify.

Potential Economic ImpactProponents argue that the new visa category could bring billions of dollars into the U.S. economy. By requiring a direct investment of $million, the policy is expected to support American businesses, boost real estate markets, and fund critical infrastructure projects. Advocates believe that it could serve as a powerful tool for economic recovery, especially in the wake of financial downturns caused by global uncertainties.

Political and Public ReactionsTrump’s proposal has been met with mixed reactions. Supporters argue that attracting wealthy investors can strengthen the economy without burdening taxpayers. Critics, however, argue that it prioritizes the wealthy over skilled immigrants, potentially creating a system where money determines immigration eligibility rather than merit. Some Democratic lawmakers have raised concerns about fairness and accessibility, emphasizing the need for comprehensive immigration reform that benefits all economic classes.

Legal and Legislative HurdlesFor the "Gold Card" visa to become law, it would require approval from Congress. Given the political divisions on immigration policies, the proposal is likely to face significant debates. If implemented, it could mark a shift in U.S. immigration priorities, focusing more on capital infusion than family reunification or employment-based visas.

Global Interest in U.S. Investment OpportunitiesThe U.S. has long been a preferred destination for global investors, particularly in real estate, technology startups, and infrastructure development. With similar investment-based visa programs existing in countries like Canada, the UK, and Australia, Trump's proposal aims to ensure that the U.S. remains competitive in attracting high-net-worth individuals

Stock Market Gains as Interest Rates Drop

As interest rates fall, investors are finding new stock opportunities. Experts suggest this trend could drive market growth in key sectors

How U.S. Investment Policies Are Evolving in 2024 and Beyond

U.S. investment policies are undergoing major changes, impacting businesses, investors, and financial markets. Learn about key updates shaping the future of investments.

The Influence of U.S. Government Regulations on Investment Strategies

U.S. government regulations significantly shape investment strategies. This article explores how recent changes in policy impact businesses, investors, and financial markets

How U.S. Policy Shifts Influence Investment Approaches

U.S. investment strategies must evolve as government policies shift. This article explores how investors can adapt to changes in regulations and market conditions.

How Regulatory Evasion is Shaping Modern Investment Strategies

As companies and financial markets increasingly challenge regulations, investors must adapt to new risks and opportunities in this evolving economic landscape

How U.S. Tax Laws Influence Investment Strategies

U.S. tax laws play a crucial role in shaping investment decisions. This article explores how changes in tax policies impact investor behavior, asset allocation, and financial outcomes.

How U.S. Investment Regulations Influence Stock Market Movements

U.S. investment regulations play a crucial role in shaping stock market trends. This article explores the impact of regulatory changes on investor behavior, market volatility, and long-term market outlook

Market Strength, Innovation, and Growth Drive U.S. Stocks

U.S. equities continue to outperform, driven by strong earnings, economic resilience, and innovation. Investors remain bullish on long-term market growth

Strategic Equity Insights for Navigating Market Volatility

The stock market remains uncertain amid economic shifts. Systematic equity strategies provide a data-driven approach to managing risk and optimizing returns

The Atlantic Daily

Get our guide to the day’s biggest news and ideas, delivered to your inbox every weekday and Sunday mornings. See more newsletters

.webp)

Ideas That Matter

Subscribe and support more than 160 years of independent journalism.

Subscribe