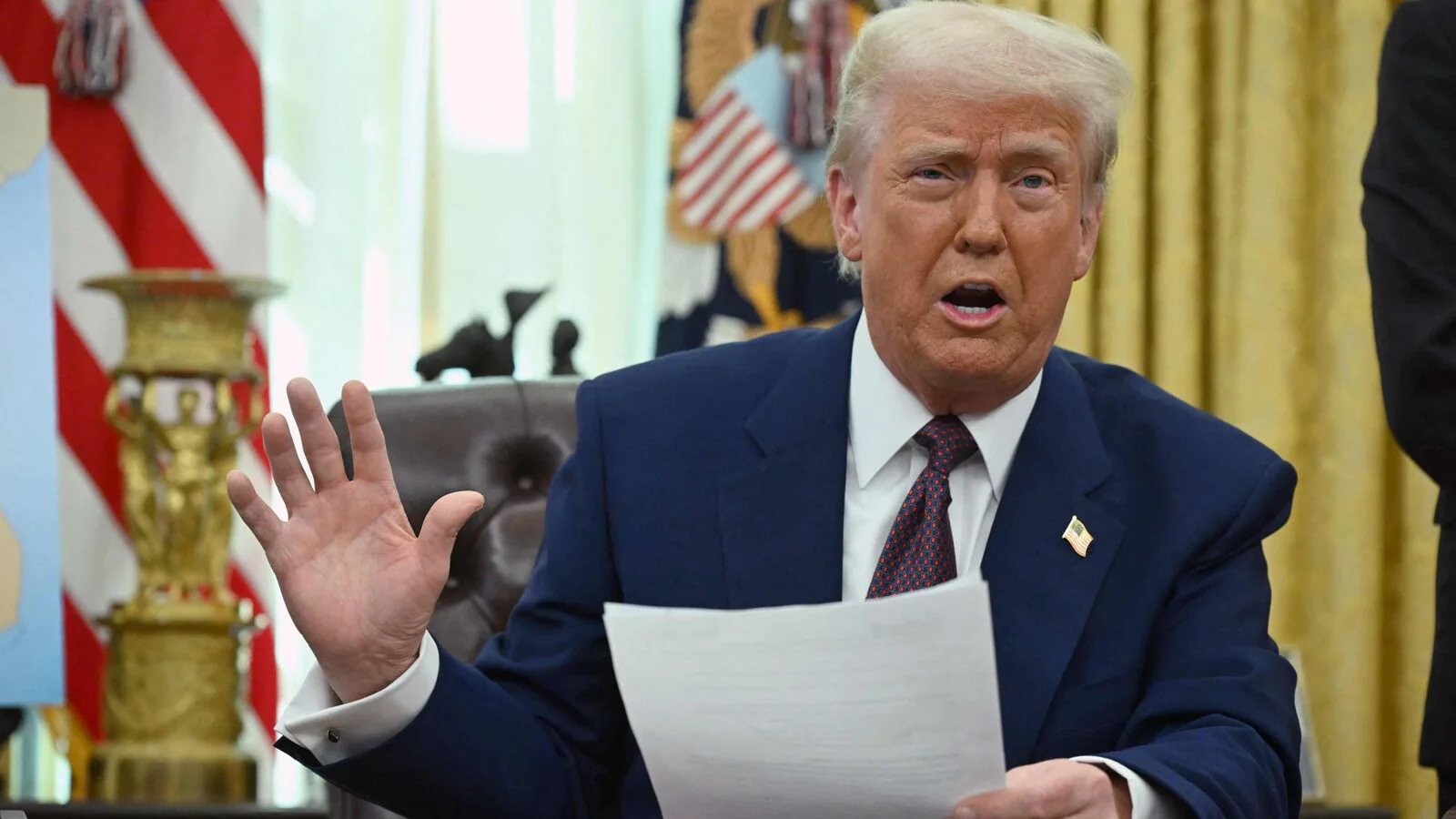

Trump’s $5M ‘Gold Card’ visa aims to attract wealthy investors

February 27, 2025

Former President Donald Trump has proposed a new immigration policy known as the $million "Gold Card" visa, designed to attract high-net-worth individuals willing to invest in the United States. This initiative offers fast-tracked residency in exchange for a significant financial contribution, with the goal of stimulating economic growth.

While the policy is seen as a potential game-changer for the U.S. investment landscape, it has also sparked controversy over the fairness of wealth-based immigration policies. Here’s a closer look at how the "Gold Card" visa would work, its potential impact, and the challenges it may face.

How the "Gold Card" Visa WorksThe "Gold Card" visa would be available to foreign investors who meet the following criteria:

The EB-Immigrant Investor Program has long been the primary pathway for foreign investors seeking U.S. green cards. However, it requires a $800,minimum investment in targeted employment areas (TEAs) and proof that the investment creates at least U.S. jobs.

Trump’s "Gold Card" visa offers a higher investment threshold but removes bureaucratic hurdles related to job creation. Key differences include:

Feature EB-Visa "Gold Card" Visa Minimum Investment $800, $million Job Creation Requirement Yes No Processing Time Lengthy Expedited Sector-Specific Investment No restrictions Limited to key industries Economic and Market ImpactIf implemented, the "Gold Card" visa could generate billions in foreign direct investment, with several potential benefits:

While supporters argue that the program will bring economic benefits, critics have raised several concerns:

For the "Gold Card" visa to become law, it must pass through Congress, where immigration policies remain a highly divisive issue.

Trump’s proposed $million "Gold Card" visa is an ambitious attempt to reshape U.S. immigration policy by prioritizing wealthy investors. While it has the potential to boost economic growth, its success will depend on political support, implementation strategies, and public reception.

As discussions continue, the future of this program remains uncertain, but one thing is clear—wealth-based immigration policies will remain a hot topic in U.S. politics.

Stock Market Gains as Interest Rates Drop

As interest rates fall, investors are finding new stock opportunities. Experts suggest this trend could drive market growth in key sectors

How U.S. Investment Policies Are Evolving in 2024 and Beyond

U.S. investment policies are undergoing major changes, impacting businesses, investors, and financial markets. Learn about key updates shaping the future of investments.

The Influence of U.S. Government Regulations on Investment Strategies

U.S. government regulations significantly shape investment strategies. This article explores how recent changes in policy impact businesses, investors, and financial markets

How U.S. Policy Shifts Influence Investment Approaches

U.S. investment strategies must evolve as government policies shift. This article explores how investors can adapt to changes in regulations and market conditions.

How Regulatory Evasion is Shaping Modern Investment Strategies

As companies and financial markets increasingly challenge regulations, investors must adapt to new risks and opportunities in this evolving economic landscape

How U.S. Tax Laws Influence Investment Strategies

U.S. tax laws play a crucial role in shaping investment decisions. This article explores how changes in tax policies impact investor behavior, asset allocation, and financial outcomes.

How U.S. Investment Regulations Influence Stock Market Movements

U.S. investment regulations play a crucial role in shaping stock market trends. This article explores the impact of regulatory changes on investor behavior, market volatility, and long-term market outlook

Market Strength, Innovation, and Growth Drive U.S. Stocks

U.S. equities continue to outperform, driven by strong earnings, economic resilience, and innovation. Investors remain bullish on long-term market growth

Strategic Equity Insights for Navigating Market Volatility

The stock market remains uncertain amid economic shifts. Systematic equity strategies provide a data-driven approach to managing risk and optimizing returns

The Atlantic Daily

Get our guide to the day’s biggest news and ideas, delivered to your inbox every weekday and Sunday mornings. See more newsletters

.webp)

Ideas That Matter

Subscribe and support more than 160 years of independent journalism.

Subscribe